Tamara's Family Story

“Something scary was at my house!” says 5-year-old Romeo. “It was a guy who had a gun and shot our apartment.”

His mom, Tamara, explains more about the incident. “It was about 8:30 at night,” she says. “I was slowly falling asleep on my bed, and my son was up watching cartoons on the couch. My window was wide open, and all I heard was just popping sounds. I jumped up and ran to the front room, pulled Romeo off the couch, and I just held him on the floor. Then we just went straight into the bathroom.”

Some of the windows are still broken. “If you walk around, you can see where all the bullet holes are,” she says. “If it would have gone through the wall, it would have hit me.”

The mother and son have lived in the apartment for two years, after Family Promise housed them in church facilities for several months. But while it’s a roof over their heads, between the crime and the cockroaches it isn’t an ideal situation.

Tamara, who teaches at a daycare, does her best to provide Romeo with memorable and fun experiences. With relatives, they plan to visit Puerto Rico in March, and they’ve also taken cruises to Texas, Mexico, and California.

“We saw dolphins!” Romeo remembers. “They were playing with a ball.”

Tamara recalls hammerhead sharks, too, and incredible views. “We saw the sun setting,” she explains. “In the clouds, it looked like a fireball just landed into a little hole, like it didn’t go down. And then we were coming back from California, and it was July 2nd, and we saw all the fireworks.”

Closer to home, Romeo has vivid memories of the swordfish at the Denver Aquarium. “It looked like a chainsaw!” he says.

Tamara learned about our homeownership program from a colleague who also owns a Pikes Peak Habitat home, but before she could qualify, she had to pay off her car loan. When she got the call saying she’d been accepted, she left her assistant in charge and ran to her coworker’s classroom to share the news.

Since her acceptance, she’s been working hard on her sweat equity – the 200 hours each future homeowner invests in building their home and those of their neighbors.

“I’ve been there every weekend. I love it!” says Tamara. “The workers always bring out the best in you. You get to meet so many new people, so many other families, and just telling everybody a little about our story, it really touches people.”

Future homeowners learn the basics of construction, landscaping, and home maintenance – and they also have the opportunity to form relationships before they even move into their new community.

“I actually got to show Isxel her dirt!” says Tamara. Isxel, another future Pikes Peak Habitat homeowner, will live a few houses away. “She was so excited.”

Adding to the connections, another Pikes Peak Habitat homeowner’s child is a student at the daycare where Tamara works. She’s excited that Romeo already knows one of his new neighbors and that he’ll have other kids to play with in the community.

“Since we’ve been so closed off, I feel like it would be good for him to experience new things,” she says. “I’m just trying to make a better life for me and him, because we’ve been through so much. I feel like we need a break – and this is a huge blessing.”

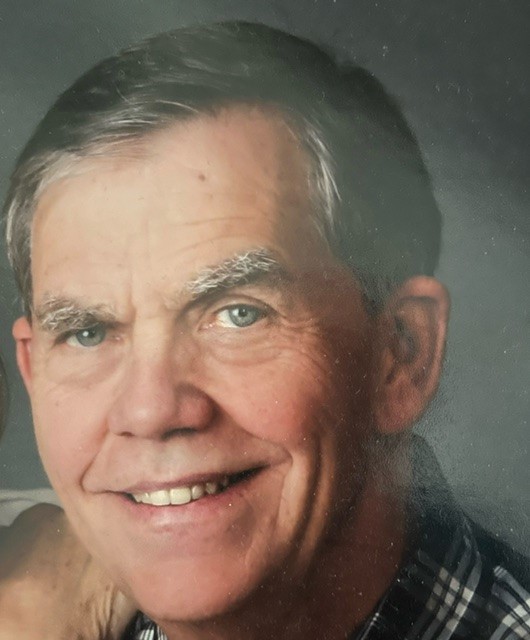

The Paul Johnson Memorial Build

The Paul Johnson Memorial Build commemorates Johnson, who served as Pikes Peak Habitat for Humanity's executive director from 1997 until his retirement in 2014. Under his leadership, Pikes Peak Habitat launched our first ReStore at 411 S. Wahsatch Ave., Colorado Springs, CO 80903, 20 years ago. Proceeds from that store, along with a second Pikes Peak Habitat ReStore -- which opened at 6250 Tutt Blvd., Colorado Springs, 80923, in 2022 -- have contributed to the construction of 128 homes in El Paso County. He also spearheaded the development of two neighborhood communities: Woodmen Vistas in Colorado Springs, where Pikes Peak Habitat built 37 homes, and Country Living in Fountain, with 34.

Pikes Peak Habitat opened in 1986 and had built 25 houses when Johnson assumed leadership. The spring he retired, the affiliate dedicated its 125th -- and Johnson's 100th -- home. Now another home will serve as a tribute to Johnson's support of affordable homeownership for workforce families here in El Paso County.